What Does it Mean to Lock in your Mortgage Rate?

UrbanTurf January 10, 2025

UrbanTurf January 10, 2025

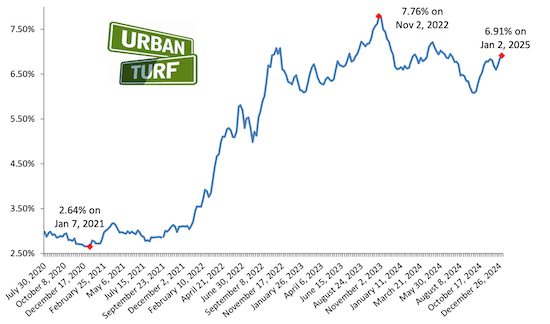

Today, UrbanTurf offers a brief explanation of what it means to lock in an interest rate.

When a homebuyer locks in a mortgage rate, that means they have agreed to a specific interest rate for a specified period of time with their lender, usually ranging from 30 to 90 days. This agreement ensures that the borrower will receive the same interest rate, even if market interest rates increase during that period.

When a borrower applies for a mortgage, the lender will typically offer a quoted interest rate. However, this rate is not guaranteed until the borrower decides to lock it in. Once the rate is locked in, the borrower and the lender are bound to that rate for the agreed-upon period, even if market interest rates rise or fall during that time. If the borrower decides to delay the rate lock, they run the risk of the rate increasing, which could result in higher mortgage payments.

Locking in a mortgage rate may come with some fees or costs that vary depending on the lender and the terms of the loan. Additionally, some lenders may offer a rate lock that lasts longer than 90 days, but these longer locks may come with higher fees or a higher interest rate.

Stay up to date on the latest real estate trends.

Local Spotlight

Fleur and Veronique's passion for travel has significantly enriched their understanding of diverse cultures and unique requirements. Their personal experience as expatriates further enhances their ability to cater to the needs of an international clientele seeking insight into life in Washington DC. Fleur's remarkable history of achievements serves as a testament to her expertise. Don't hesitate to contact Fleur's team to discover more about how they can assist you!